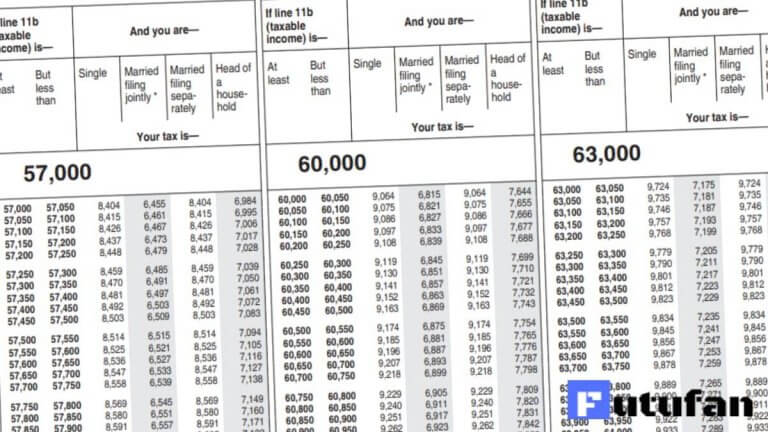

compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. We may also receive compensation if you click on certain links posted on our site. We may receive compensation from our partners for placement of their products or services. While we are independent, the offers that appear on this site are from companies from which receives compensation. Compare tax filing servicesį is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. For 2021, the maximum limit is $3,600 for individual plans and $7,200 for family plans. If you have a high-deductible healthcare plan, open a health savings plan and contribute as much as you can. For example, if you make $60,000 a year and contribute $19,500 to your 401(k), your taxable income drops to $40,500. So, one of the easiest ways to reduce your taxable income is to max out your retirement accounts. For example, if your highest tax bracket is 24%, a $1,000 deduction may trim $240 off your tax bill.Īnytime you save money in a taxed-deferred retirement or health savings account, it lowers your taxable income. Want to calculate how much a deduction will save you in taxes? Use your highest income tax bracket as a guide. Common items you can write off on your taxes include charitable contributions, medical expenses, mortgage interest, property taxes, states and local income taxes, business expenses and more. Tax deductions lower your taxable income dollar-for-dollar, which could drop you into a lower tax bracket. American opportunity tax credit (education credit).If you have a $3,000 tax bill but qualify for $1,000 in credits, your bill is reduced to $2,000. Tax credits lower your tax bill dollar-for-dollar. There are three ways to lower your tax bill: through credits, deductions and tax-deferred savings contributions. The federal government breaks your income up into chunks, and you pay a different tax rate for each chunk.įor example, if you’re a single tax filer who made $40,000 in 2021, you’ll pay a 10% tax on the first $9,950 you made and 12% of the amount ranging from $9,950 to $40,000 when you file in 2022.

Irs 2021 tax brackets plus#

$156,355 plus 37% of the amount over $523,600Ĭontrary to popular belief, being in a tax bracket doesn’t mean you pay that percentage on your total income.

Head of household 2022 federal income tax brackets Tax bracket 2022 federal income tax brackets Tax bracket

Married filing separately 2022 federal income tax brackets Tax bracket

$162,718 plus 37% of the amount over $539,900Ģ021 federal income tax brackets Tax bracket Single 2022 federal income tax brackets Tax bracket

0 kommentar(er)

0 kommentar(er)